Introduction:

In the dynamic landscape of today’s business environment, uncertainties and risks are inevitable. Whether you are an individual, a business owner, or part of a larger organization, the ability to navigate these risks effectively is paramount. Risk mitigation strategies play a crucial role in safeguarding against potential threats that could disrupt operations or financial stability. One of the key tools in this arsenal is insurance – a comprehensive shield that can be crafted to protect against a myriad of risks.

Understanding Risk Mitigation:

Risk mitigation involves the identification, assessment, and prioritization of potential risks followed by the application of strategies to minimize, control, or eliminate their impact. It is a proactive approach that aims to reduce the likelihood and severity of adverse events. While there are various risk mitigation techniques, insurance is a fundamental and versatile tool that provides financial protection when things go awry.

Crafting Your Insurance Shield:

- Risk Assessment: Before crafting your insurance shield, a thorough risk assessment is essential. Identify and evaluate potential risks specific to your situation or business. This could include risks related to property damage, liability, employee health, cybersecurity, and more.

- Customization of Coverage: Insurance is not a one-size-fits-all solution. Work closely with insurance providers to tailor coverage that aligns with your unique risks and needs. This might involve a combination of policies such as property insurance, liability insurance, business interruption insurance, and cyber insurance.

- Comprehensive Property Insurance: Property insurance is a foundational element of any insurance shield. It covers physical assets such as buildings, equipment, and inventory against risks like fire, theft, or natural disasters. Ensure that the coverage adequately reflects the value of your assets.

- Liability Protection: Liability insurance protects against legal claims and associated costs. This is crucial for businesses, as lawsuits can arise from various sources, including customers, employees, or other third parties. Tailor liability coverage to your industry and potential exposures.

- Employee Welfare: Consider insurance options that safeguard the well-being of your employees. This can include health insurance, disability insurance, and workers’ compensation. A healthy and secure workforce contributes to business continuity.

- Business Interruption Coverage: Unforeseen events such as natural disasters or accidents can disrupt operations. Business interruption insurance provides coverage for lost income and additional expenses during the downtime, ensuring financial stability during recovery.

- Cybersecurity Insurance: In an increasingly digital world, the threat of cyber-attacks is a significant concern. Cybersecurity insurance protects against the financial fallout of data breaches, hacking, and other cyber threats.

- Regular Review and Updates: The risk landscape evolves, and so should your insurance shield. Regularly review and update your coverage to ensure it remains aligned with your current risk profile. Changes in operations, expansion, or new regulations may necessitate adjustments.

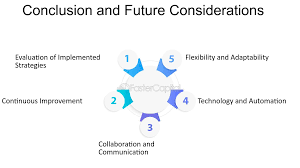

Conclusion:

Crafting a robust insurance shield is an integral part of mastering risk mitigation. By understanding your unique risks, customizing coverage, and staying vigilant with regular reviews, you can build a comprehensive and adaptive insurance strategy. In an unpredictable world, a well-crafted insurance shield provides the peace of mind and financial security necessary to weather the storms that may come your way.